How to Build Credit as a New Immigrant: Your Essential Guide to Financial Success in the U.S.

Key Takeaway

- The Foundation of Financial Stability: Building a strong credit history is crucial for financial success in the U.S., affecting everything from housing opportunities to loan accessibility.

- Starting from Scratch: Many immigrants begin their U.S. journey without a credit history, but with the right strategies, establishing a solid credit foundation is achievable.

- Strategic Credit Building: Utilizing tools such as secured credit cards, credit builder loans, and reporting rent and utility payments can kickstart your credit history.

- Common Pitfalls: Being informed about potential challenges, such as the risks of overborrowing and predatory lending, is key to a successful credit-building journey.

- Patience and Consistency: Building a strong credit score is a marathon, not a sprint, requiring consistent financial behavior and time.

Welcome to the United States! As a new immigrant, building credit history in the U.S. is one of the most important steps you can take toward long-term financial stability. Whether you’re applying for housing, a credit card, or a car loan, a strong credit history opens doors. At New Omni Bank, we specialize in helping immigrants build U.S. credit from scratch—so you can thrive with confidence.

Understanding the US Credit System and the Role of Credit Scores

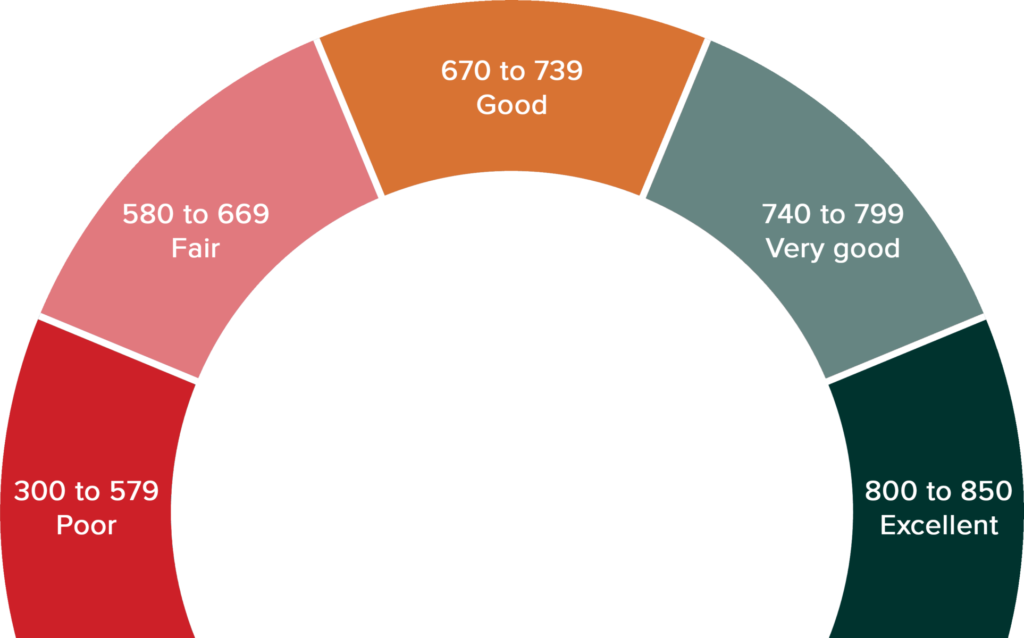

The U.S. credit system may seem unfamiliar, especially if you’re just starting to build credit history as an immigrant. But understanding how it works is the first step to success. Your credit report is maintained by credit bureaus and includes a credit score, which ranges from 300 to 850: poor, fair, good, very good, and excellent. A score of 700 or above is generally considered good, and a score of 800 or above is considered excellent.

Your credit score is calculated based on several factors, including:

- Payment history

- Amounts owed

- Length of credit history

- New credit, and

- Types of credit in use

Why Immigrants Need to Build a Strong Credit History

Starting fresh in the U.S. often means starting without a credit history. This “credit invisibility” can be a barrier to essential services. However, using the right credit building strategies for immigrants, you can establish a solid credit foundation and unlock opportunities.

Strategies for Building Your Credit History as an Immigrant

Diversify with Small, Manageable Loans

Taking out small loans like an auto loan or home mortgage and repaying them responsibly can significantly boost your credit. At New Omni Bank, we offer loans that help you build credit while meeting your financial needs.

Report Rent and Utility Payments

Regular payments such as rent and utilities can be reported to credit bureaus through third-party services. These consistent payments reflect positively on your credit report.

Use a Co-Signer

A co-signer with strong credit can help you qualify for loans or credit cards. Their established credit history supports your application.

Apply for a Credit Builder Loan

A credit builder loan for immigrants is a smart way to establish a credit score. Payments are reported to the credit bureaus and help demonstrate financial responsibility.

Apply for a Secured Credit Card

Secure credit cards for immigrants are ideal for newcomers. You provide a deposit, which becomes your credit limit. Responsible use builds your credit history over time.

Use Credit Cards Strategically

Keep balances low and always pay on time. These habits show you’re a reliable borrower and help improve your credit score.

Become an Authorized User

Being added as an authorized user to a trusted person’s credit card can boost your credit, as their positive history appears on your report.

Common Mistakes to Avoid

Borrow Within Your Means

Overborrowing can lead to financial stress. Always use credit responsibly.

Avoid Predatory Lending

Be cautious of lenders offering fast approval with high fees. Stick to reputable institutions like New Omni Bank.

Make Timely Payments

Payment history is the most important credit score factor. Never miss a due date.

Safeguard Your Information

Monitor your credit regularly to catch fraud or errors early. Protecting your financial identity is key to your credit health.

Authorized User

Being added as an authorized user to a trusted person’s credit card can boost your credit, as their positive history appears on your report.

How Long Does It Take to Build Credit as a New Immigrant?

- Initial Score: It can take three to six months of activity for your first credit score to be generated.

- Progress: With responsible use, significant improvements can show within 12 to 18 months.

- Long-Term Growth: Over several years, your score will strengthen as you add accounts like credit builder loans or secured credit cards for immigrants.

Everyone’s journey is different, but consistency is crucial.

Monitor Your Credit Report

Reviewing your credit report helps ensure accuracy and spot issues. Get your free annual reports at:

- Visit annualcreditreport.com

- Call 1-877-322-8228, or

- Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281, Atlanta, GA 30348-5281

Start Your Financial Journey with Confidence

Building credit history as an immigrant is achievable with the right tools and guidance. From credit builder loans to secured credit cards, New Omni Bank is here to support your path to financial success. Let’s build more than credit—let’s build your future, together.

Contact us to navigate the complexities of the U.S. financial system.