About New Omni Bank

FDIC-Insured - Backed by the full faith and credit of the U.S. Government.

FDIC-Insured - Backed by the full faith and credit of the U.S. Government.

Our Company

Menu

- Home

- /

- Business

- /

- Business Deposit

- /

- Business Funds More Than the FDIC Limit

Insured Business Funds Over $250,000

Insured Business Funds Over $250,000

Protect Your Large Deposits with FDIC Insurance

At New Omni Bank, we understand the importance of protecting your large deposits while still maintaining growth and liquidity. That is why we offer two services to access aggregate FDIC insurance across network banks IntraFi®’s ICS® (available in money market accounts and/or demand deposit accounts) and CDARS® (available in CD accounts) solutions.

Note: A list identifying IntraFi network banks appears here. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply.

For Consumers

We can protect and grow your large CD funds through our CDARS solution. Learn more here.

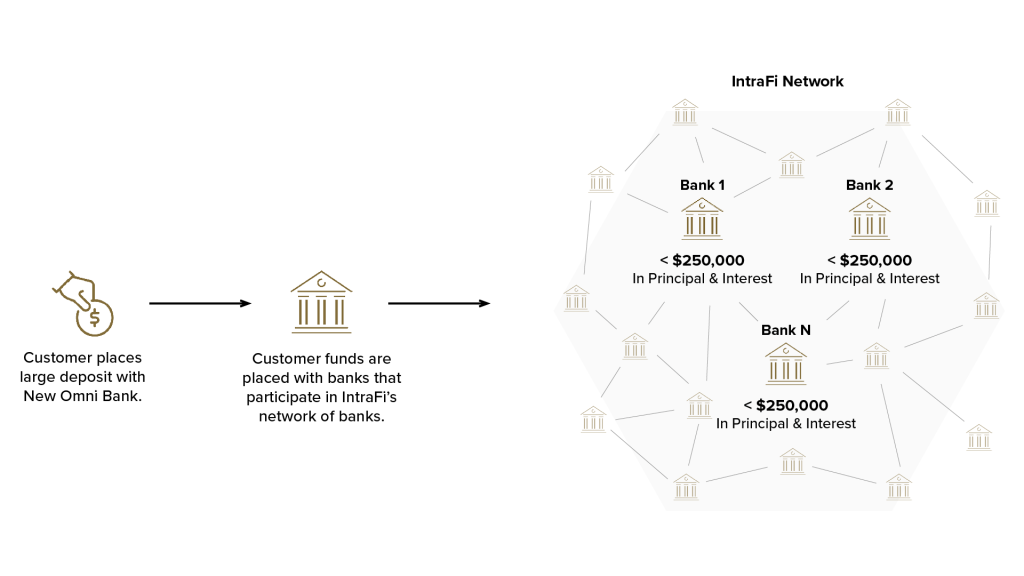

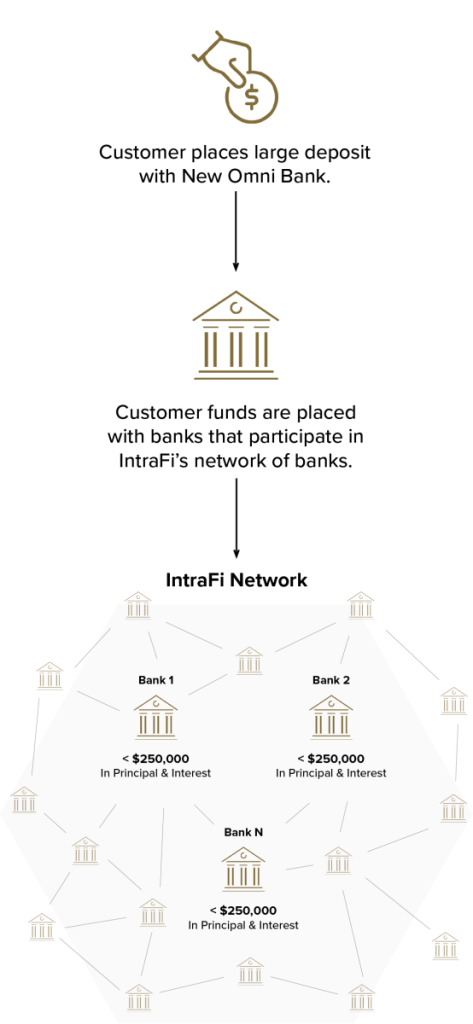

How It Works?

What are IntraFi's ICS and CDARS solutions?

IntraFi is a trusted provider of expanded deposit insurance services, offering large deposits that exceed the standard FDIC insurance limit of $250,000 access to aggregate FDIC insurance across network banks. Through IntraFi, you can access comprehensive FDIC insurance on your deposits via two key solutions:

- ICS, IntraFi Cash Service®: Available as demand deposit accounts (DDAs) and money market deposit accounts (MMDAs), ICS allows you to enjoy liquidity and, with MMDAs, earn competitive interest rates.

- CDARS, Certificate of Deposit Account Registry Service®: Offered as certificates of deposit (CDs), CDARS allows you to grow your savings with competitive rates and daily compounding interest, while your entire balance is eligible to FDIC insurance.

Want to learn more? Read this blog post to explore how you can insure funds beyond the standard FDIC limit.

For Liquidity: Choose ICS

1. You Deposit

Place your large deposit in an MMA or DDA (or both) at New Omni Bank.

2. We Protect

Your funds in the account are spread across multiple FDIC-insured institutions within IntraFi, providing your entire balance access to FDIC insurance.

3. You Earn

Enjoy competitive interest rates with the MMA option, while your funds remain eligible to FDIC protection.

For Growth: Choose CDARS

1. You Deposit

Place your large funds in a CD account at New Omni Bank and choose from 26-week or 52-week term.

2. We Protect

Your funds in the account are spread across multiple FDIC-insured institutions within IntraFi, protecting your entire balance.

3. You Earn

Grow your savings with competitive CD rates and daily compounding interest while keeping your deposits eligible to FDIC insurance in the millions

Features & Benefits

Added FDIC Coverage

Your deposits are automatically placed across multiple FDIC-insured banks, providing access to aggregate FDIC protection beyond the standard $250,000.

Streamlined Management

Manage your funds easily with one account and one statement, all through a single, trusted banking relationship.

Personalized, Local Service

Work with our dedicated team to find the right solution for your unique needs.

Get Started Today

Ready to protect and grow your large deposits? Contact us for a free consultation and learn how our ICS and CDARS solutions can provide you with the security, flexibility, and growth you need.

Frequently Asked Questions

1. What is IntraFi?

IntraFi is a leading provider of deposit insurance services that allows individuals and businesses to access millions of dollars in aggregate FDIC insurance across network banks, through a single bank relationship.

Note: A list identifying IntraFi network banks can be found at www.IntraFi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage.

2. How does IntraFi work?

IntraFi’s services: ICS and CDARS provide access to aggregate FDIC insurance on large deposits by distributing your funds across a network of FDIC-insured banks. When you open a Money Market Deposit Account, Demand Deposit Account, or Certificate of Deposit with New Omni Bank, our ICS and CDARS solutions automatically spread your deposits across these institutions, ensuring no single bank holds more than $250,000 and protecting your entire balance.

3. What is the difference between ICS and CDARS?

- ICS is typically used by businesses for liquid accounts like Money Market Deposit Accounts (MMDAs) or Demand Deposit Accounts (DDAs), making it ideal for businesses that need easy access to funds while still benefiting from FDIC protection.

- CDARS is used by individuals for certificates of deposit (CDs), offering longer-term savings options with competitive interest rates while providing FDIC coverage for large deposits.

4. Can I earn interest with ICS or CDARS?

Yes! With ICS, if you choose a Money Market Deposit Account (MMDA), you can earn competitive interest rates while maintaining access to your funds. With CDARS, you can earn competitive rates on longer-term CDs, with daily compounding interest.

5. Do I have to open accounts at multiple banks to use ICS or CDARS?

No, you only need to manage your account(s) at New Omni Bank. We take care of distributing your funds across multiple FDIC-insured banks to ensure full coverage. You manage everything through one bank relationship, with one statement and one point of contact.

6. Are there fees for using ICS or CDARS?

New Omni Bank does not charge additional fees for using ICS or CDARS accounts. However, the interest rates may vary depending on the product and terms you choose.

7. How do I access my funds if they are spread across multiple banks?

With ICS, you can deposit or withdraw your funds easily by working directly with New Omni Bank—there’s no need to manage multiple banking relationships. CDARS accounts function as CDs, so your funds will be available upon maturity or renewal.

8. How do I open an account that offers IntraFi’s ICS and CDARS services?

You can open the account through New Omni Bank. Contact us for more information.

9. What happens if a bank in the IntraFi network fails?

If a bank in IntraFi network fails, your deposits will be fully protected by the FDIC.

Deposit placement through an IntraFi service is subject to the terms, conditions, and disclosures in applicable agreements. Deposits that are placed through an IntraFi service at FDIC-insured banks in IntraFi’s network are eligible for FDIC deposit insurance coverage at the network banks. The depositor may exclude banks from eligibility to receive its funds. To meet conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Although deposits are placed in increments that do not exceed the FDIC standard maximum deposit insurance amount (“SMDIA”) at any one destination bank, a depositor’s balances at the institution that places deposits may exceed the SMDIA before settlement for deposits or after settlement for withdrawals. The depositor must make any necessary arrangements to protect such balances consistent with applicable law and must determine whether placement through an IntraFi service satisfies any restrictions on its deposits. IntraFi, the IntraFi logo, IntraFi Cash Service, ICS, and CDARS are registered trademarks of IntraFi LLC.

Related Services

Elite Membership

This checking account offers advanced transaction management, reporting, and security for larger corporations.

Membership Money Market

Let your idle cash earn competitive interest with easy access to help ensure your business liquidity.

Business CDs

Let your business funds grow at your own pace by earning high interest rates with our Certificates of Deposit.

Get in Touch.

To help put you in touch with the right team, please answer the following questions.