How to Build Credit as a New Immigrant: Your Essential Guide to Financial Success in the U.S.

Key Takeaway

- The Foundation of Financial Stability: Building a strong credit history is crucial for financial success in the U.S., affecting everything from housing opportunities to loan accessibility.

- Starting from Scratch: Many immigrants begin their U.S. journey without a credit history, but with the right strategies, establishing a solid credit foundation is achievable.

- Strategic Credit Building: Utilizing tools such as secured credit cards, credit builder loans, and reporting rent and utility payments can kickstart your credit history.

- Common Pitfalls: Being informed about potential challenges, such as the risks of overborrowing and predatory lending, is key to a successful credit-building journey.

- Patience and Consistency: Building a strong credit score is a marathon, not a sprint, requiring consistent financial behavior and time.

Welcome to the United States! As you embark on this exciting new chapter, one of the cornerstones of achieving financial stability and unlocking opportunities is building a strong credit history. At New Omni Bank, we’re dedicated to guiding immigrants like you through the intricacies of the US financial system, ensuring you’re well-equipped to establish and maintain a robust financial foundation.

Understanding the US Credit System and the Role of Credit Scores

The US credit system might seem complex, but it’s based on a simple principle: your history of borrowing and repaying money. This history is tracked by credit bureaus and compiled into your credit report, which includes your credit score—a numerical representation of your creditworthiness.

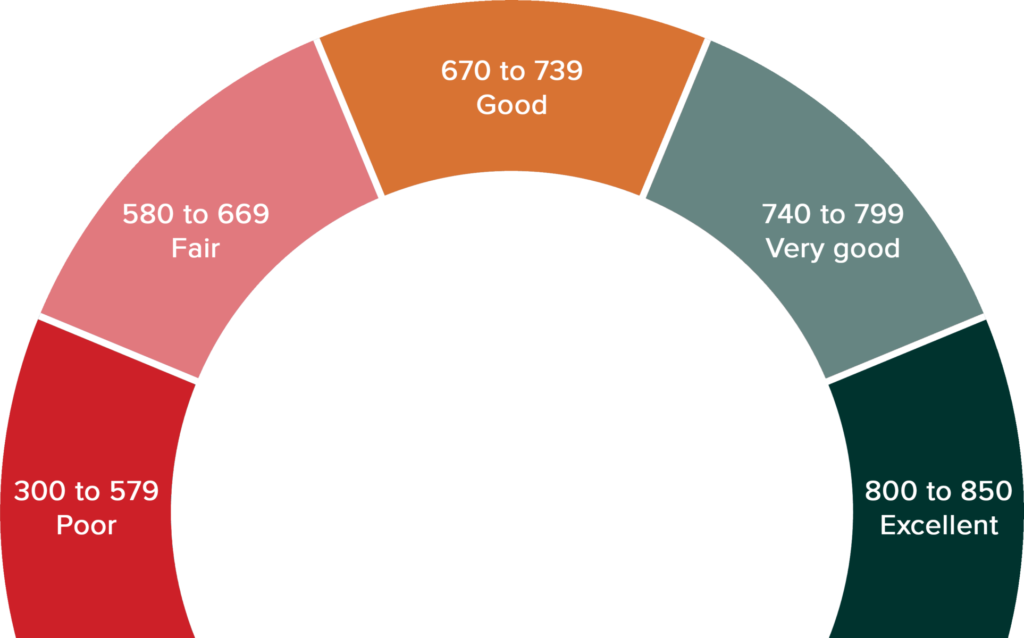

Scores range from 300 to 850 and are divided into five categories: poor, fair, good, very good, and excellent. A score of 700 or above is generally considered good, and a score of 800 or above is considered excellent.

Your credit score is calculated based on several factors, including:

- Payment history

- Amounts owed

- Length of credit history

- New credit, and

- Types of credit in use

Why Immigrants Need to Build a Strong Credit History

Starting anew in the U.S. often means starting from scratch with your credit history. This “credit invisibility” can be a barrier to renting homes, securing loans, and accessing essential services. However, with the right strategies, building a strong credit history is not only possible but can be a smooth process.

Strategies for Building Your Credit History as an Immigrant

Starting anew in the U.S. often means starting from scratch with your credit history. This “credit invisibility” can be a barrier to renting homes, securing loans, and accessing essential services. However, with the right strategies, building a strong credit history is not only possible but can be a smooth process.

- Diversify Your Credit with Small, Manageable Loans: Taking out small loans, like an auto loan or a home mortgage, and repaying them responsibly can significantly boost your credit. At New Omni Bank, we offer home mortgages and auto loans that not only meet your needs but also help you build your credit history.

- Report Rent and Utility Payments to Credit Bureaus: Regular payments you make, like rent and utilities, can also help build your credit when they’re reported to credit bureaus. Services are available that can help report these payments.

- Use a Co-Signer: Having a trusted friend or relative with established credit co-sign a loan or credit card application can increase your chances of approval. Their credit history can help you qualify for better terms and rates.

- Apply for a Credit Builder Loan: A credit builder loan is an installment loan with fixed monthly payments, similar to a personal loan, auto loan, and mortgage. Payments you make toward your credit builder loan are reported to the credit bureaus and can help you establish a credit score.

- Apply for a Secure Credit Card: A secured credit card is an excellent way for immigrants to begin building credit. It requires a cash deposit that typically serves as your credit limit. Use it responsibly, and you’ll lay the groundwork for a solid credit history.

- Use Credit Card Strategically for Maximum Impact: Keep your credit card balances low and pay off your bills on time. This shows you’re a responsible borrower and can improve your credit score.

- Become an Authorized User on Someone Else’s Account: If someone trusts you enough to add you as an authorized user on their credit card, their account history can appear on your credit report, potentially boosting your score.

Navigating Potential Concerns and Common Mistakes

As you embark on your journey to build credit, awareness of potential pitfalls is key to steering clear of common mistakes. Here’s how to navigate these challenges effectively:

- Borrow Within Your Means: Avoid the temptation of overborrowing. Understand your financial capacity, and only use credit that you can comfortably repay.

- Be Wary of Predatory Lending: Choose reputable lenders and be cautious of offers that seem too good to be true, as they often come with high fees and interest rates.

- The Importance of Timely Payments: Late payments can severely impact your credit score. Prioritize making payments on time, every time, to build a positive credit history.

- Safeguard Your Information: Protect your personal and financial information to prevent fraud and identity theft. Regularly monitor your credit report for any unauthorized activities.

How Long Does It Take to Build Credit as a New Immigrant?

Building a credit history in the U.S. is a journey that requires patience and consistent effort. As a new immigrant, you might wonder how long it will take before you have a credit score that opens opportunities for lower interest rates, higher loan amounts, and better financial products.

- Starting From Scratch: If you’re starting without any U.S. credit history, obtaining your first credit account is the initial step. It can take up to six months of account activity before a credit score can be calculated. During this period, it’s crucial to make timely payments and demonstrate responsible credit use.

- Seeing Significant Improvement: After establishing a credit score, seeing significant improvements depends on various factors, including the strategies you employ. Generally, with consistent responsible behavior, such as paying bills on time, keeping balances low, and cautiously managing new credit applications, you could see noticeable improvements in your credit score within 12 to 18 months.

- Long-term Goals: Building a strong credit history is a long-term goal. Over several years, as you continue to use credit responsibly and diversify your credit accounts (for example, through auto loans or mortgages like those offered by New Omni Bank), your credit history will strengthen, reflecting your reliability as a borrower.

Remember: Everyone’s financial situation is unique, and there’s no one-size-fits-all timeline. The key to building a strong credit score as a new immigrant is consistency in your financial habits and patience as your credit history grows.

Monitoring Your Credit Score and Report

It is crucial to consistently review your credit report to understand your credit health, correct any inaccuracies, and identify potential fraud early on. To obtain your free annual credit reports, instead of contacting the three major credit bureaus—Equifax, Experian, and TransUnion—separately, access your free reports through the following authorized channels:

- Visit AnnualCreditReport.com

- Call 1-877-322-8228, or

- Complete the Annual Credit Report Request Form and mail it to Annual Credit Report Request Service at P.O. Box 105281, Atlanta, GA 30348-5281

Empowering Your Financial Journey in the U.S.

Remember, building a robust credit history is a marathon, not a sprint. It requires patience, diligence, and a strategic approach. By diversifying your credit, monitoring your credit report, and employing advanced credit-building strategies, you’re not just improving your credit score—you’re opening doors to a future filled with possibilities. Lower interest rates, better loan terms, and access to a wider range of financial products can all be within your reach.

At New Omni Bank, we’re more than just a financial institution; we’re your partner on this journey. Contact us to navigate the complexities of the U.S. financial system. Let’s build not just credit, but confidence and community, as you establish your new life in the United States.